Small Scale LNG Market Size, Share | CAGR of 7.1% – Market.us

Small-Scale Liquefied Natural Gas (LNG) Market: A Report on Growth, Trends, and Contributions to Sustainable Development Goals

Executive Summary

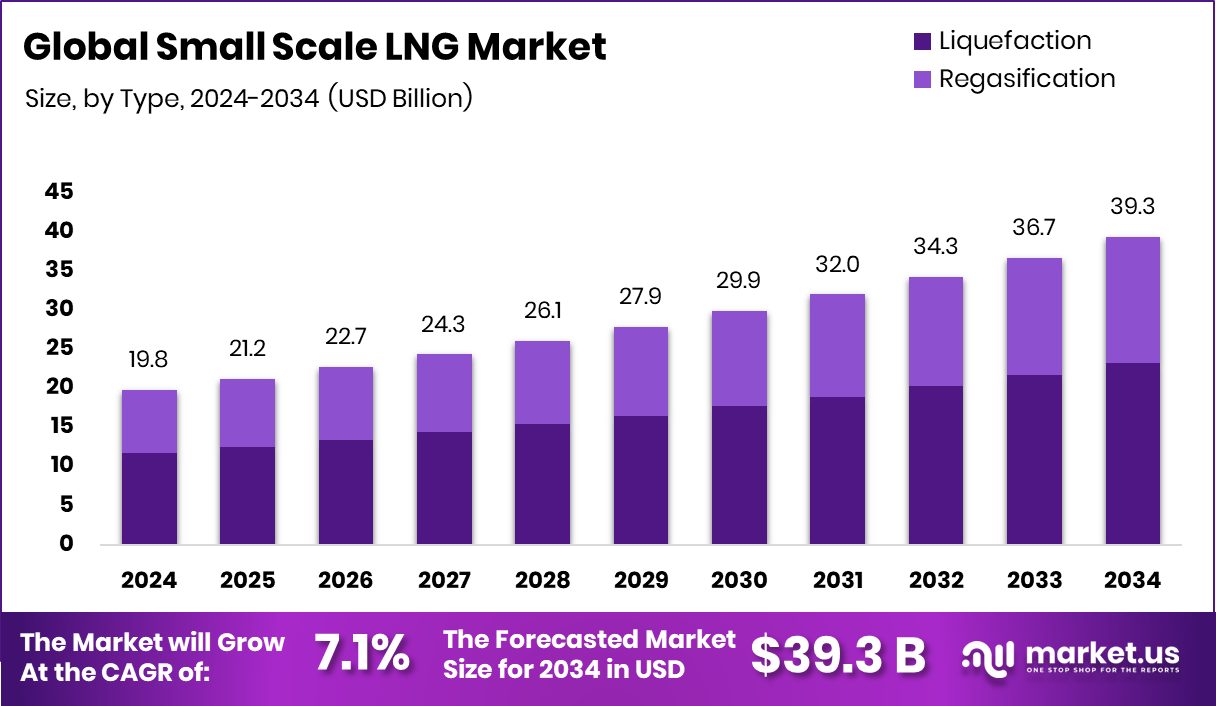

The global Small-Scale LNG market is projected to expand from USD 19.8 billion in 2024 to USD 39.3 billion by 2034, registering a Compound Annual Growth Rate (CAGR) of 7.1%. This growth is intrinsically linked to the pursuit of global Sustainable Development Goals (SDGs), particularly in providing cleaner, more accessible energy. Small-scale LNG infrastructure is critical for delivering liquefied natural gas to regions and industries lacking pipeline access, thereby supporting SDG 7 (Affordable and Clean Energy) by enhancing energy security for off-grid communities. As a lower-emission alternative to diesel and heavy fuel oil, its adoption in transport and power generation directly contributes to SDG 13 (Climate Action) and SDG 11 (Sustainable Cities and Communities) by reducing greenhouse gas emissions and improving air quality. The market’s expansion, driven by investments in sustainable infrastructure, also aligns with SDG 9 (Industry, Innovation, and Infrastructure).

Key Findings and Alignment with SDGs

- Market Growth: The projected growth to USD 39.3 billion by 2034 underscores the increasing global reliance on transitional fuels to meet climate targets.

- Liquefaction Dominance: Liquefaction technologies, holding a 59.2% market share, are fundamental to creating decentralized energy systems, advancing SDG 7 by enabling energy access in remote areas.

- Logistical Framework: Trucks represent the primary mode of supply with a 57.6% share, providing the logistical flexibility required to support SDG 9 by building resilient infrastructure for industries disconnected from traditional energy grids.

- Application in Transport: Heavy-duty vehicles are the largest application segment (39.1%), highlighting the market’s role in decarbonizing the transport sector and contributing to SDG 11 and SDG 13.

- Regional Leadership: The Asia-Pacific region, with a 43.90% market share, demonstrates the critical role of small-scale LNG in powering economic development while addressing energy poverty and environmental goals.

Market Segmentation Analysis

By Type: Liquefaction and Regasification

The liquefaction segment commanded a 59.2% market share in 2024. This dominance is attributed to the strategic importance of converting natural gas into a transportable liquid form, which is the foundational step in the small-scale LNG supply chain. These facilities are instrumental in achieving SDG 7 by enabling the distribution of cleaner energy to off-grid industrial sites and communities, fostering inclusive and sustainable industrialization as outlined in SDG 9.

By Mode of Supply: Trucks, Trans-shipment, and Bunkering

Truck-based distribution holds a 57.6% share, serving as the most adaptable and cost-effective method for last-mile delivery. This logistical capability is essential for reaching nascent markets and remote consumers, thereby ensuring equitable energy access (SDG 7). This mode of supply underpins the development of resilient local infrastructure (SDG 9) without the extensive capital investment required for pipelines.

By Application: Heavy-Duty Vehicles, Marine Transport, and Industry

Heavy-duty vehicles accounted for 39.1% of the market, driven by the transport industry’s transition away from diesel to reduce emissions. This shift directly supports efforts to create sustainable transportation systems under SDG 11 and mitigates climate change impacts as per SDG 13. The growing use in marine transport also addresses SDG 14 (Life Below Water) by reducing pollutants from shipping.

Market Dynamics and SDG Implications

Driving Factors

Increased investment in clean fuel infrastructure is a primary market driver. Public and private funding for upgrading maritime ports and logistics networks enhances the viability of small-scale LNG. Such investments directly foster the development of sustainable and resilient infrastructure (SDG 9), facilitate cleaner maritime transport (SDG 14), and expand access to affordable and clean energy (SDG 7) for coastal and remote industries.

Restraining Factors

The high upfront capital cost of LNG infrastructure, including storage and regasification units, remains a significant barrier. This financial hurdle can slow the adoption of cleaner energy solutions, particularly in developing regions, thereby impeding progress toward SDG 7 and SDG 9. Overcoming this requires innovative financing models and policy support to de-risk investments in sustainable energy systems.

Growth Opportunities

The decarbonization of marine transport presents a substantial growth opportunity. As the maritime industry seeks to comply with stringent emissions regulations, small-scale LNG offers a viable, lower-emission fuel for ferries, coastal vessels, and port equipment. This transition is crucial for protecting marine ecosystems (SDG 14) and advancing global climate action (SDG 13).

Latest Trends

A key trend is the development of multi-fuel and hybrid marine solutions that can utilize LNG, bio-LNG, and other low-carbon alternatives. This technological innovation, aligned with SDG 9, positions small-scale LNG as a vital transitional fuel in the long-term strategy for decarbonizing the shipping industry, contributing to both SDG 13 and SDG 14.

Regional Analysis

The Asia-Pacific region dominated the market with a 43.90% share (USD 8.6 billion), driven by the imperative to meet rising energy demands sustainably. The deployment of small-scale LNG in the region is a direct response to the need for reliable power for industrial growth (SDG 9) and improved energy access for its vast population (SDG 7). North America and Europe are also significant markets, with growth spurred by regulatory pressures to reduce emissions in transport and industry, furthering progress on SDG 11 and SDG 13. Latin America and the Middle East & Africa are emerging regions, leveraging small-scale LNG to reduce reliance on more polluting fuels in remote operations.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Player Contributions to Sustainable Development

Leading companies in the market are advancing SDGs through technological innovation and strategic investments.

- LINDE PLC: Specializes in gas processing and liquefaction technologies that enable the development of compact, efficient LNG solutions, directly supporting the creation of decentralized clean energy systems (SDG 7 and SDG 9).

- WÄRTSILÄ CORPORATION: Develops clean-energy engines and integrated LNG systems for marine and power applications. Its innovations are critical for reducing emissions in the shipping industry, contributing to SDG 13 and SDG 14.

- HONEYWELL INTERNATIONAL INC.: Provides advanced automation and control systems that enhance the safety and efficiency of small-scale LNG facilities, promoting sustainable industrial practices in line with SDG 9.

Recent Developments

- February 2025: Linde’s commitment to building 64 new on-site plants reinforces the trend toward distributed gas production, enhancing energy resilience and access (SDG 7).

- October 2024: Wärtsilä’s introduction of its “NextDF” dual-fuel engine technology, which significantly cuts methane emissions, represents a major technological step forward for sustainable marine transport, directly addressing SDG 13 and SDG 14.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article on the Small-Scale LNG Market connects to several Sustainable Development Goals (SDGs) by focusing on energy transition, infrastructure development, and environmental impact reduction. The primary SDGs addressed are:

- SDG 7: Affordable and Clean Energy: The core theme of the article is the expansion of small-scale LNG as a “cleaner fuel option” to provide energy to regions without access to major pipelines, for “remote power generation,” and for “off-grid markets.” This directly aligns with ensuring access to modern and cleaner energy.

- SDG 9: Industry, Innovation, and Infrastructure: The article emphasizes the significant investments being made in “clean fuel infrastructure,” including “liquefaction units,” “small ports, LNG-ready terminals, and coastal logistics.” This highlights the development of resilient and sustainable infrastructure to support a growing industry.

- SDG 11: Sustainable Cities and Communities: The article points to the high adoption of LNG by “Heavy-duty Vehicles” to “reduce emissions” and “cut diesel dependence.” This shift contributes to improving air quality in urban and transport corridors, a key aspect of sustainable cities.

- SDG 13: Climate Action: The market’s growth is explicitly linked to “broader decarbonization efforts” and the need to meet “tightening environmental norms.” The development of technologies like dual-fuel engines that “cut methane emissions” is a direct measure aimed at mitigating climate change.

- SDG 14: Life Below Water: The article identifies a major growth opportunity in cleaning up “marine transportation.” The shift to LNG as a marine fuel is presented as a way to create “low-emission fuels” for the shipping industry, thereby reducing pollution that affects marine ecosystems.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the article’s discussion of LNG as a cleaner fuel and the investments in its infrastructure, the following specific SDG targets can be identified:

- Target 7.1: Ensure universal access to affordable, reliable and modern energy services.

- The article states that small-scale LNG is “designed to serve regions or industries that cannot access major pipeline networks” and is used for “remote power generation” and “off-grid markets,” directly addressing the goal of expanding energy access.

- Target 7.a: Enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.

- The text highlights numerous investments, such as “NextDecade securing $1.8 billion,” “Canada’s $49 million investment,” and a “federal commitment of up to $200 million to support a project shipping LNG to Asia,” which exemplify the promotion of investment in clean energy infrastructure.

- Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being.

- The article discusses the expansion of “LNG and clean-fuel infrastructure,” including “small ports, LNG-ready terminals, and coastal logistics,” which are essential for creating a reliable and sustainable energy supply chain.

- Target 9.4: Upgrade infrastructure and retrofit industries to make them sustainable… with greater adoption of clean and environmentally sound technologies.

- The adoption of LNG by “Heavy-duty Vehicles” and “Marine Transport” to replace “diesel and heavy fuel oil” is a clear example of retrofitting industries with cleaner technology. The mention of “advanced control systems and automation technologies” also points to this target.

- Target 11.6: Reduce the adverse per capita environmental impact of cities, including by paying special attention to air quality.

- The article notes that a key driver for LNG adoption in “Heavy-duty Vehicles” (39.1% market share) is the need to “reduce emissions” and “cut diesel dependence,” which directly contributes to improving urban air quality.

- Target 14.1: Prevent and significantly reduce marine pollution of all kinds.

- The article identifies a “key growth opportunity” in the “push to clean up marine transportation.” The adoption of LNG as a “sustainable marine fuel” is a direct strategy to reduce emissions and pollution from shipping.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

The article provides several quantitative and qualitative indicators that can be used to measure progress towards the identified SDG targets:

- Financial Investment in Clean Energy Infrastructure: The article quantifies investments, such as “$1.8 billion for the Rio Grande LNG project,” “$49 million into hydrogen liquefaction,” “€11.5 million… to deploy biogas liquefaction,” and “$35 million in maritime infrastructure funds.” These figures serve as direct indicators of progress for Target 7.a and 9.1.

- Market Growth and Size: The projection of the market growing from “USD 19.8 billion in 2024” to “USD 39.3 billion by 2034” at a “CAGR of 7.1%” indicates the rate of adoption of this cleaner energy source (Target 7.1).

- Market Share by Application and Mode: The article specifies market shares, such as “Heavy-duty vehicles… holding 39.1%” and “Trucks dominate the… supply modes, securing a significant 57.6%.” These percentages can be used as indicators for the penetration of cleaner fuels in transport (Target 9.4 and 11.6).

- Regional Market Dominance: The data that “Asia-Pacific dominated the Small Scale LNG Market with 43.90%, reaching USD 8.6 Bn” indicates where energy access and infrastructure development are expanding most rapidly (Target 7.1 and 9.1).

- Technological Advancement and Emission Reduction: The mention of Wärtsilä’s new engine technology “designed to cut methane emissions to as low as 1.1 %” is a specific, measurable indicator of technological innovation aimed at climate action (Target 13.2).

SDGs, Targets, and Indicators Summary

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 7: Affordable and Clean Energy | 7.1: Ensure universal access to affordable, reliable and modern energy services. 7.a: Promote investment in energy infrastructure and clean energy technology. |

– Market growth from USD 19.8 billion to USD 39.3 billion by 2034. – Provision of energy to “off-grid markets” and “remote power generation.” – Specific investments mentioned: $1.8 billion (Rio Grande), $49 million (Canada), €11.5 million (SUBLIME Energie). |

| SDG 9: Industry, Innovation, and Infrastructure | 9.1: Develop quality, reliable, sustainable and resilient infrastructure. 9.4: Upgrade infrastructure and retrofit industries to make them sustainable. |

– Investment of over $35 million in maritime infrastructure funds. – Market share of supply modes: Trucks at 57.6%. – Market share of applications: Heavy-duty vehicles at 39.1%. |

| SDG 11: Sustainable Cities and Communities | 11.6: Reduce the adverse per capita environmental impact of cities, including by paying special attention to air quality. | – 39.1% market share held by heavy-duty vehicles, driven by the need to “reduce emissions” and “cut diesel dependence.” |

| SDG 13: Climate Action | 13.2: Integrate climate change measures into national policies, strategies and planning. | – Development of new engine technology to “cut methane emissions to as low as 1.1 %.” – Market growth driven by “broader decarbonization efforts” and “tightening environmental norms.” |

| SDG 14: Life Below Water | 14.1: Prevent and significantly reduce marine pollution of all kinds. | – Investment of $14 million in technology to “decarbonise maritime transport.” – Growth in demand for LNG as a “sustainable marine fuel” to clean up marine transportation. |

Source: market.us

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

;Resize=620#)