OECD Nations Face Steeper FDI Decline Than Emerging Economies – Information Technology and Innovation Foundation (ITIF)

Analysis of Global Foreign Direct Investment Trends and Implications for Sustainable Development Goals

Overview of FDI Decline and its Impact on SDG Financing

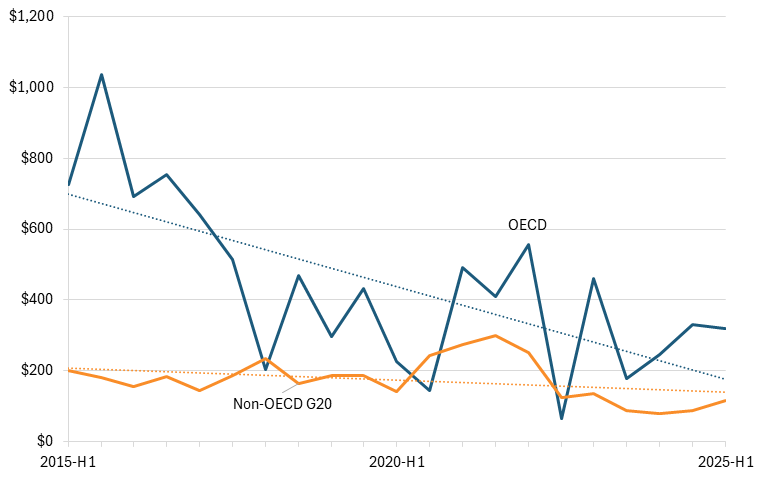

Global Foreign Direct Investment (FDI) flows, a critical source of financing for the Sustainable Development Goals (SDGs), have demonstrated a concerning trend, declining by approximately 3 percent annually over the past decade. This reduction in capital flow poses a significant challenge to achieving the 2030 Agenda, particularly SDG 17 (Partnerships for the Goals), which relies on robust international financial cooperation.

- Overall Global Decline: Nearly 3% per year over the last ten years.

- OECD Nations: Accounted for a larger share of the decline, with flows decreasing by 3.8% annually since 2015.

- Non-OECD G20 Nations: Experienced a more modest annual decline of 2.5% over the same period.

Recent data accentuates this divergence, with FDI inflows to the OECD decreasing by 31 percent in the last two years, compared to a 14 percent decline in non-OECD G20 countries. This disparity affects the global capacity to finance projects related to SDG 8 (Decent Work and Economic Growth) and SDG 9 (Industry, Innovation, and Infrastructure).

Divergent National Trends and their Relation to SDG 8

Individual country performance highlights varied progress towards leveraging FDI for SDG 8. While major economies have seen significant declines, others have experienced growth, indicating a shifting landscape for investment aimed at sustainable economic development.

- United States: Inward FDI declined by 17 percent.

- China: Inward FDI declined by 24 percent.

- India: Inward FDI increased by 45 percent, showcasing a positive environment for attracting capital for development.

Analysis of FDI Components: Mergers & Acquisitions (M&A)

FDI is composed of two primary categories, each with distinct implications for sustainable development. Mergers and acquisitions (M&A), which involve the transfer of ownership of existing assets, have shown divergent trends between developed and developing economies.

- Global M&A Trend: A 4 percent decline in the first half of 2025.

- Advanced Economies: Experienced a sharp 9 percent decline, potentially limiting the recapitalization of industries for green transitions (SDG 13).

- Emerging Economies: Saw a significant increase of over 30 percent, suggesting a strengthening of South-South cooperation and investment that can be channeled towards achieving national SDG targets.

Analysis of FDI Components: Greenfield Investment and its Role in SDG 9

Greenfield investment, which involves the creation of new facilities and productive assets, is fundamental to achieving SDG 9 (Industry, Innovation, and Infrastructure). This form of FDI directly contributes to building resilient infrastructure, promoting inclusive and sustainable industrialization, and fostering innovation.

- Advanced Economies: Greenfield investment increased sharply in 2025, indicating a potential focus on building new, potentially more sustainable, industrial capacity.

- Emerging Economies: Greenfield investment declined, a worrying trend that could hamper long-term development and the structural transformation needed to meet the SDGs.

Despite the recent decline, greenfield projects constitute 80 percent of total FDI in emerging nations, underscoring their critical importance for development. In contrast, they represent only 43 percent in advanced economies and a mere 5 percent in the United States.

Strategic Imperatives for Aligning FDI with Sustainable Development

The observed trends present a challenge to global competitiveness and the achievement of the SDGs. A renewed strategic focus is required to attract FDI, particularly greenfield investments that directly support sustainable development objectives.

- Promote Greenfield FDI: Nations must prioritize attracting greenfield FDI to build new productive capacities aligned with SDG 9, such as renewable energy infrastructure (SDG 7) and sustainable industrial parks.

- Enhance Investment Climate: Advanced economies, including the United States, must enhance their attractiveness for long-term, sustainable investment to avoid eroding their capacity to innovate and lead in green technologies (SDG 13).

- Strengthen Global Partnerships: The international community must work to reverse the decline in FDI to ensure adequate financing is available to achieve the 2030 Agenda, in line with the principles of SDG 17.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 8: Decent Work and Economic Growth

The article’s central theme is Foreign Direct Investment (FDI), a critical driver of economic activity. The text discusses how declining FDI trends are “troubling” for the “long-term competitiveness” of nations, directly linking investment flows to sustained economic growth.

-

SDG 10: Reduced Inequalities

The analysis explicitly compares and contrasts FDI flows between different economic groups: “advanced economies” (OECD) and “emerging economies” (non-OECD G20 countries). This highlights the disparities in international investment and economic opportunities between countries at different stages of development.

-

SDG 17: Partnerships for the Goals

FDI is a key mechanism for international financial partnership. The article is entirely focused on tracking these global financial flows, which are a primary component of SDG 17’s goal to “Strengthen the means of implementation and revitalize the Global Partnership for Sustainable Development.”

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Target 8.1: Sustain per capita economic growth

The article’s conclusion, which states that the United States “risks losing its attractiveness as an investment location and eroding its long-term competitiveness” without a focus on attracting FDI, directly relates to the goal of sustaining economic growth. FDI is presented as a necessary component for maintaining economic health.

-

Target 10.b: Encourage financial flows, including foreign direct investment, to states where the need is greatest

The article directly addresses this target by analyzing and quantifying FDI flows to different groups of countries. It compares the decline in FDI to OECD nations (3.8% annually) with the more modest decline in non-OECD G20 countries (2.5% annually), and highlights growth in specific emerging economies like India (45% increase).

-

Target 17.3: Mobilize additional financial resources for developing countries from multiple sources

FDI is a primary example of a financial resource mobilized from external, private sources. The article’s detailed breakdown of FDI flows into mergers & acquisitions and greenfield investments for both advanced and emerging economies is a direct analysis of the financial resources discussed in this target.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicator: Inward FDI flows (billions USD)

This is the primary indicator used throughout the article and is explicitly mentioned in the caption for Figure 1. It directly measures the volume of financial flows relevant to Target 10.b and Target 17.3. The article provides specific data points, such as the 31% decrease in FDI inflows to the OECD and the 45% increase to India.

-

Indicator: Value of mergers and acquisitions (billion USD)

The article uses this specific metric (Figure 2) to disaggregate total FDI flows. It notes that mergers and acquisitions declined by 9% in advanced economies while increasing by over 30% in emerging economies, providing a granular measure of one type of international investment.

-

Indicator: Value of greenfield investment (billion USD)

This is another specific indicator (Figure 3) used to break down FDI. The article highlights that greenfield investment “increased sharply in 2025” in advanced economies while declining in emerging economies. This metric is crucial for measuring investment in new productive capacity, which is directly linked to economic growth (SDG 8).

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators Identified in the Article |

|---|---|---|

| SDG 8: Decent Work and Economic Growth | 8.1: Sustain per capita economic growth in accordance with national circumstances. | Value of greenfield investment (as a measure of new productive capacity contributing to growth). |

| SDG 10: Reduced Inequalities | 10.b: Encourage official development assistance and financial flows, including foreign direct investment, to States where the need is greatest. | Inward FDI flows (billions USD), compared between OECD and non-OECD G20 countries. |

| SDG 17: Partnerships for the Goals | 17.3: Mobilize additional financial resources for developing countries from multiple sources. | Total inward FDI flows (billions USD); Value of mergers and acquisitions (billion USD); Value of greenfield investment (billion USD). |

Source: itif.org

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0