Has Universal Health Services Run Ahead of Itself After 25% Rally and Network Expansion? – simplywall.st

Universal Health Services (UHS) Performance and Alignment with Sustainable Development Goals (SDGs)

Corporate Developments and Contribution to SDG 3

An analysis of Universal Health Services (UHS) reveals significant corporate activities that align with the United Nations Sustainable Development Goal 3: Good Health and Well-being. The company’s recent strategic initiatives demonstrate a commitment to expanding healthcare access and infrastructure, which are critical components for achieving global health targets.

- Expansion of Behavioral Health Network: This initiative directly supports SDG Target 3.4, which aims to promote mental health and well-being. By increasing capacity and access to mental healthcare, UHS contributes to reducing premature mortality from non-communicable diseases.

- New Managed Care Agreements: Securing new agreements enhances the company’s ability to provide services to a broader population, aligning with SDG Target 3.8 concerning the achievement of universal health coverage, including financial risk protection and access to quality essential healthcare services.

Market performance reflects investor confidence in this strategy, with the stock showing a 24.8% year-to-date increase. This financial stability is crucial for the long-term sustainability of its health services, underpinning its ongoing contribution to SDG 3.

Financial Valuation and Sustainable Growth Prospects

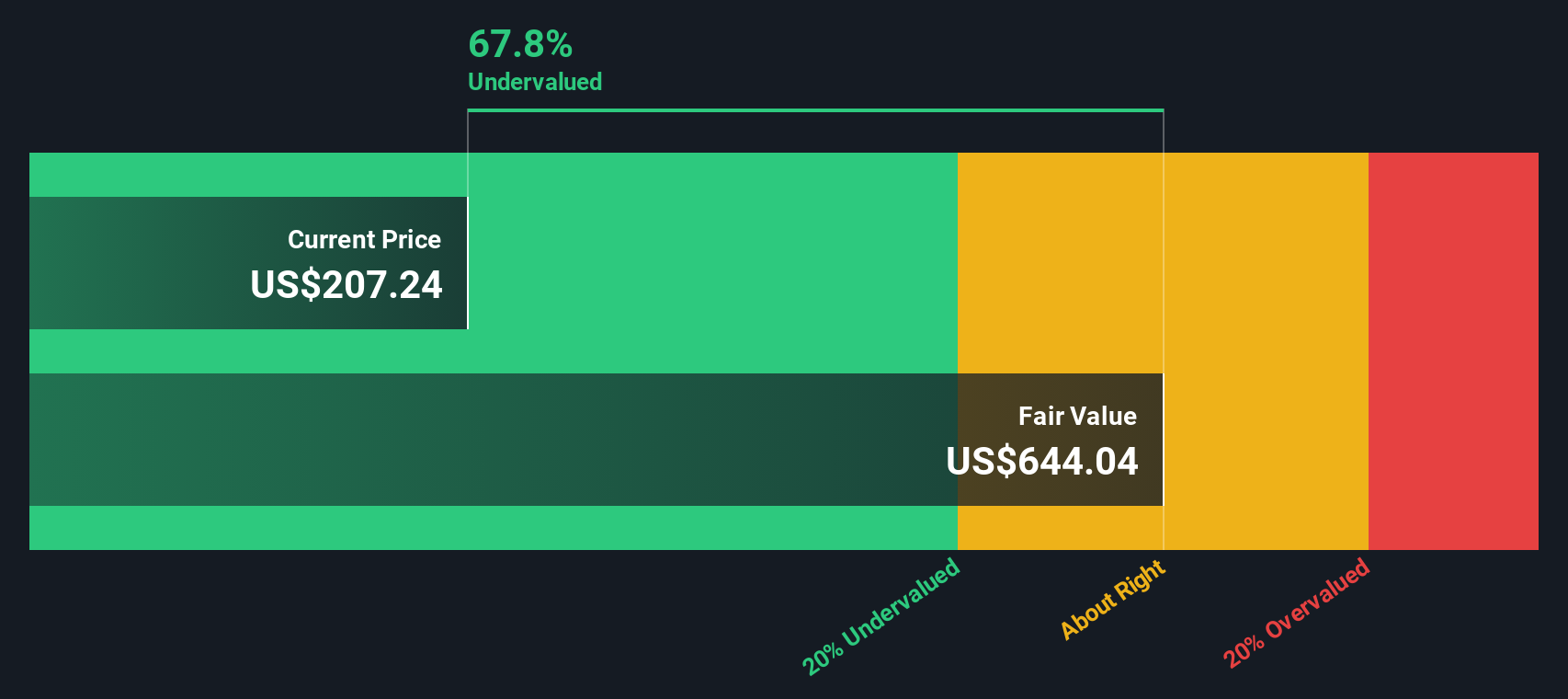

A comprehensive valuation of Universal Health Services indicates that its current market price may not fully reflect its intrinsic value and its long-term potential to contribute to sustainable health outcomes. Two primary methodologies were employed to assess the company’s financial standing.

Discounted Cash Flow (DCF) Analysis

The DCF model projects a company’s future cash flows to determine its present value, offering a long-term perspective on its financial sustainability. This is essential for an organization whose mission is aligned with long-term societal goals like SDG 3.

- Current Free Cash Flow (FCF): UHS reports a current FCF of $1.00 billion.

- Projected FCF Growth: Analyst projections estimate FCF will reach $2.02 billion by 2035, indicating sustained operational strength.

- Calculated Intrinsic Value: The DCF analysis yields an intrinsic value of $644 per share, which is 65.2% above its current market price.

Conclusion: UNDERVALUED. This suggests that the market undervalues the company’s capacity for sustained growth and its role in strengthening the healthcare infrastructure necessary for achieving Good Health and Well-being (SDG 3).

Price-to-Earnings (PE) Ratio Analysis

The PE ratio provides a comparative valuation by measuring the company’s current share price relative to its per-share earnings. A lower PE ratio can indicate an efficient and well-managed organization, a key attribute for sustainable service delivery in the healthcare sector.

- UHS PE Ratio: 10.37x

- Healthcare Industry Average PE Ratio: 20.66x

- Proprietary Fair Ratio Benchmark: 21.95x

Conclusion: UNDERVALUED. The company’s PE ratio is significantly lower than both the industry average and its tailored Fair Ratio. This discrepancy suggests that UHS operates with an efficiency that supports the sustainable and affordable delivery of healthcare, a core principle of SDG 3.

Strategic Outlook and Stakeholder Perspectives on SDG Impact

Diverse stakeholder perspectives on the future of Universal Health Services result in a range of valuation scenarios. These differing outlooks reflect varying expectations of the company’s ability to expand its impact on global health goals while navigating market and policy dynamics. The valuation range, from a cautious $165 to an optimistic $280 per share, highlights different potential trajectories for its contribution to SDG 3. This analysis underscores that the company’s financial health is intrinsically linked to its capacity to advance the critical mission of ensuring healthy lives and promoting well-being for all.

Analysis of SDGs, Targets, and Indicators

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 3: Good Health and Well-being

- The article’s entire focus is on Universal Health Services, a company operating within the healthcare industry. The text explicitly mentions the company’s business in providing health services, including the expansion of its “behavioral health network,” which directly relates to ensuring healthy lives and promoting well-being for all ages.

-

SDG 8: Decent Work and Economic Growth

- The article is a detailed financial analysis of a major corporation. It discusses the company’s stock performance, returns, cash flow, and valuation. This focus on corporate financial health and growth is directly linked to economic growth, as successful companies like Universal Health Services contribute to the economy and provide employment.

-

SDG 17: Partnerships for the Goals

- The article mentions that Universal Health Services “landed new managed care agreements.” These agreements represent partnerships between the healthcare provider and other entities (such as insurance companies or government programs) to deliver health services. Such collaborations are essential for strengthening the implementation of health-related goals.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Under SDG 3: Good Health and Well-being

- Target 3.4: “By 2030, reduce by one third premature mortality from non-communicable diseases through prevention and treatment and promote mental health and well-being.” The article’s statement that the company “expanded its behavioral health network” directly addresses the part of this target focused on promoting mental health and well-being by increasing the capacity and availability of relevant services.

- Target 3.8: “Achieve universal health coverage, including financial risk protection, access to quality essential health-care services…” While the article does not claim the company achieves universal health coverage on its own, its core business as a major health services provider and its engagement in “new managed care agreements” are integral parts of the broader system aimed at providing access to quality healthcare.

-

Under SDG 8: Decent Work and Economic Growth

- Target 8.2: “Achieve higher levels of economic productivity through diversification, technological upgrading and innovation…” The healthcare sector is a high-value-added sector. The article’s detailed analysis of the company’s financial performance, including its “6.1% returns over the last year” and projected growth in cash flows to “$2.02 billion by 2035,” reflects its contribution to economic productivity.

-

Under SDG 17: Partnerships for the Goals

- Target 17.17: “Encourage and promote effective public, public-private and civil society partnerships…” The mention of “new managed care agreements” is a direct example of private-sector partnerships designed to deliver healthcare services effectively. These agreements are a form of the multi-stakeholder partnerships that this target aims to promote.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

For Target 3.4 (Mental Health):

- An implied indicator is the expansion of the behavioral health network. The article states this as a recent development, which serves as a qualitative measure of increased investment and capacity for mental health services.

-

For Target 3.8 (Universal Health Coverage):

- An implied indicator is the establishment of “new managed care agreements.” This indicates an expansion of structured healthcare coverage and financing mechanisms, which are essential components for achieving universal access.

-

For Target 8.2 (Economic Productivity):

- The article is rich with financial metrics that serve as direct indicators of the company’s economic performance and contribution. These include:

- Stock performance: “climbing 24.8% year-to-date.”

- Company returns: “delivered 6.1% returns over the last year.”

- Free Cash Flow (FCF): A “current Free Cash Flow (FCF) of $1.00 billion” and its projected growth.

- Price-to-Earnings (PE) ratio: A PE of “10.37x” is used to measure valuation and economic health.

- The article is rich with financial metrics that serve as direct indicators of the company’s economic performance and contribution. These include:

4. Summary Table of SDGs, Targets, and Indicators

| SDGs, Targets and Indicators | Corresponding Targets | Specific Indicators Identified in the Article |

|---|---|---|

| SDG 3: Good Health and Well-being | Target 3.4: Promote mental health and well-being. | Expansion of the company’s behavioral health network. |

| Target 3.8: Achieve universal health coverage and access to quality essential health-care services. | Establishment of “new managed care agreements.” | |

| SDG 8: Decent Work and Economic Growth | Target 8.2: Achieve higher levels of economic productivity. | Financial metrics such as stock performance (24.8% YTD growth), company returns (6.1%), and Free Cash Flow ($1.00 billion). |

| SDG 17: Partnerships for the Goals | Target 17.17: Encourage and promote effective public-private and civil society partnerships. | The landing of “new managed care agreements.” |

Source: simplywall.st

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0