Natural Gas Prices, News, Trend, Monitor, Analysis and Forecast | ChemAnalyst

The North American Natural Gas market has been characterized by several factors in Q4 of 2023.

Natural Gas prices a pivotal role in shaping the global energy landscape, influencing everything from consumer bills to industrial operations and national economies. Understanding the dynamics behind natural gas pricing requires delving into a complex web of factors, spanning supply and demand dynamics, geopolitical tensions, weather patterns, technological advancements, and environmental regulations. As one of the most widely used energy sources globally, natural gas serves as a crucial fuel for heating, electricity generation, industrial processes, and transportation.

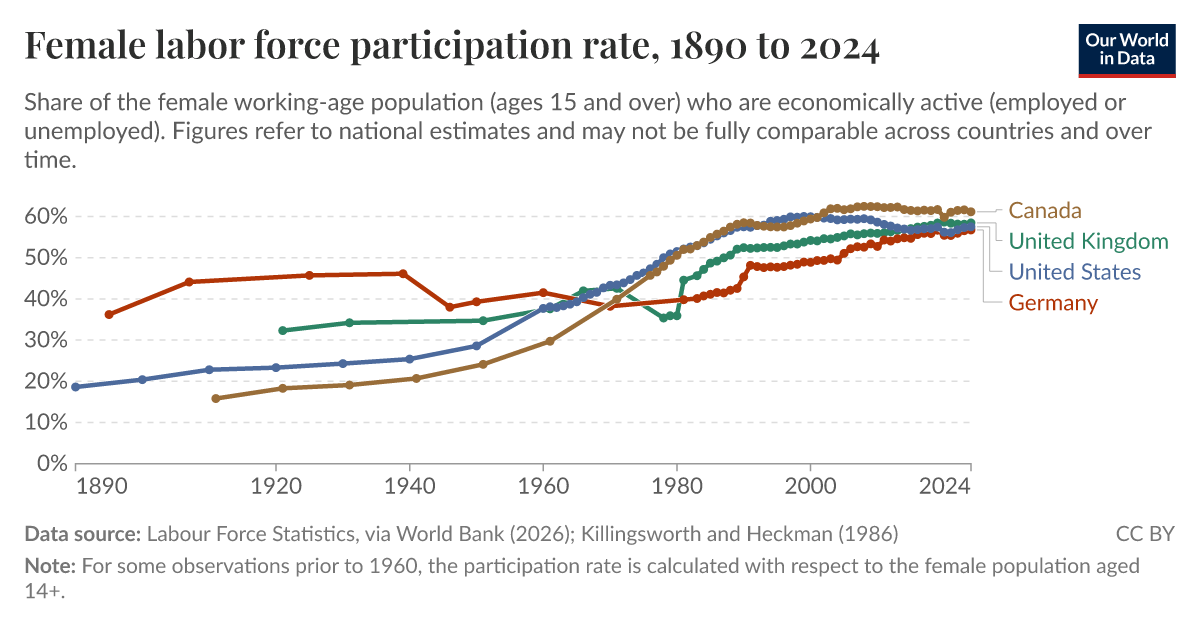

At the heart of natural gas pricing lies the interplay between supply and demand. Natural gas reserves are finite, and extracting them involves significant investment and technical expertise. Production levels are influenced by factors such as the availability of reserves, technological advancements in extraction techniques like hydraulic fracturing (fracking), and geopolitical developments affecting major gas-producing regions. Conversely, demand for natural gas is driven by factors such as population growth, economic development, weather patterns, and shifts in energy policy favoring cleaner fuels.

Geopolitical tensions and global events also exert a considerable influence on natural gas prices. Disruptions in major gas-producing regions, such as political conflicts or sanctions, can lead to supply shortages or price spikes. For instance, instability in the Middle East or tensions between major gas exporters like Russia and Ukraine can disrupt gas supplies to Europe, affecting prices worldwide. Additionally, geopolitical factors can influence investment decisions in gas infrastructure, further impacting supply dynamics and prices.

Weather patterns play a significant role in shaping natural gas prices, particularly in regions where gas is heavily used for heating or cooling. Extreme weather events such as hurricanes, polar vortexes, or heatwaves can lead to surges in demand for natural gas for heating or electricity generation, putting pressure on supply and prices. Conversely, milder weather conditions can dampen demand, leading to lower prices. Moreover, weather-related disruptions to production and transportation infrastructure can further exacerbate price volatility.

Technological advancements and innovations also influence natural gas prices by affecting production costs and supply dynamics. Advances in drilling techniques, such as horizontal drilling and hydraulic fracturing, have unlocked vast reserves of natural gas previously deemed uneconomical to extract, leading to a surge in production in regions like the United States. This influx of supply has helped moderate prices globally, altering the dynamics of the natural gas market. Similarly, developments in liquefied natural gas (LNG) technology have facilitated the transportation of gas over long distances, connecting previously isolated markets and increasing price competition.

Environmental regulations and policies aimed at addressing climate change are becoming increasingly influential in shaping natural gas prices. Natural gas is often touted as a cleaner alternative to coal and oil due to its lower carbon emissions. As such, policies favoring the use of natural gas or imposing stricter emissions standards on coal-fired power plants can boost demand for natural gas and support prices. Conversely, regulations targeting methane emissions from natural gas production or promoting renewable energy sources may dampen demand and constrain prices.

Market dynamics and investor sentiment also play a crucial role in determining natural gas prices. The natural gas market is characterized by liquidity and trading activity on commodity exchanges, where prices are determined based on supply and demand fundamentals, as well as speculation. Investor sentiment, influenced by factors such as economic indicators, geopolitical developments, and energy policy announcements, can lead to price fluctuations and volatility in the natural gas market.

In conclusion, natural gas prices are influenced by a multitude of factors, including supply and demand dynamics, geopolitical tensions, weather patterns, technological advancements, environmental regulations, and market sentiment. Understanding these complexities is essential for businesses, policymakers, and consumers seeking to navigate the volatile and interconnected world of energy markets. As the global energy landscape continues to evolve, natural gas prices will remain a key barometer of economic activity, environmental sustainability, and geopolitical stability.

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0