A Look at Hannon Armstrong (HASI) Valuation Following $500M Green Bond Issuance for Sustainability Initiatives – simplywall.st

Report on HA Sustainable Infrastructure Capital’s Green Financing and Market Performance

Green Bond Issuance and Alignment with Sustainable Development Goals (SDGs)

HA Sustainable Infrastructure Capital (HASI) has announced the issuance of $500 million in 8.000% Green Junior Subordinated Notes, due in 2056. This strategic financing initiative is designed to bolster the company’s long-term capital structure for investments in sustainable infrastructure projects. The issuance directly supports the advancement of several key United Nations Sustainable Development Goals (SDGs).

Primary SDG Contributions:

- SDG 7 (Affordable and Clean Energy): Capital will be allocated to renewable energy projects, increasing the availability of clean power.

- SDG 9 (Industry, Innovation and Infrastructure): The financing facilitates the development of resilient and sustainable infrastructure.

- SDG 11 (Sustainable Cities and Communities): Investments contribute to creating environmentally sound and sustainable urban and rural environments.

- SDG 13 (Climate Action): The green notes represent a direct mechanism for financing climate mitigation and adaptation efforts.

Market Performance and Investor Sentiment

Following the announcement, HASI’s market performance has shown significant positive momentum. This reflects growing investor confidence in business models that prioritize and integrate SDG-aligned objectives.

Key Performance Indicators:

- Recent Share Price Gain: A 23.9% increase over the past month.

- One-Year Total Shareholder Return: A total return of 16.2%.

This upward trend suggests that the market is responding favorably to the company’s strategic focus on sustainability-driven growth. The renewed optimism is linked to the potential for long-term value creation through investments that address global sustainability challenges.

Valuation Analysis in the Context of Sustainable Finance

An evaluation of HASI’s financial metrics provides insight into its market position relative to its commitment to sustainable development.

Price-to-Earnings (P/E) Ratio

HASI is currently trading at a P/E ratio of 14.2x. This valuation metric indicates market expectations regarding future profitability from green finance initiatives.

- The P/E ratio is slightly above the US Diversified Financial industry average of 14x.

- It is significantly below the peer group average of 28.8x.

This suggests that while the market acknowledges HASI’s growth potential tied to its SDG-focused portfolio, it has not yet assigned the premium valuation seen in some competitors. The valuation reflects a market that is still calibrating the long-term financial returns of sustainable investments. External factors, including interest rate fluctuations and regulatory shifts in climate policy, remain key risks that could influence future market sentiment and returns.

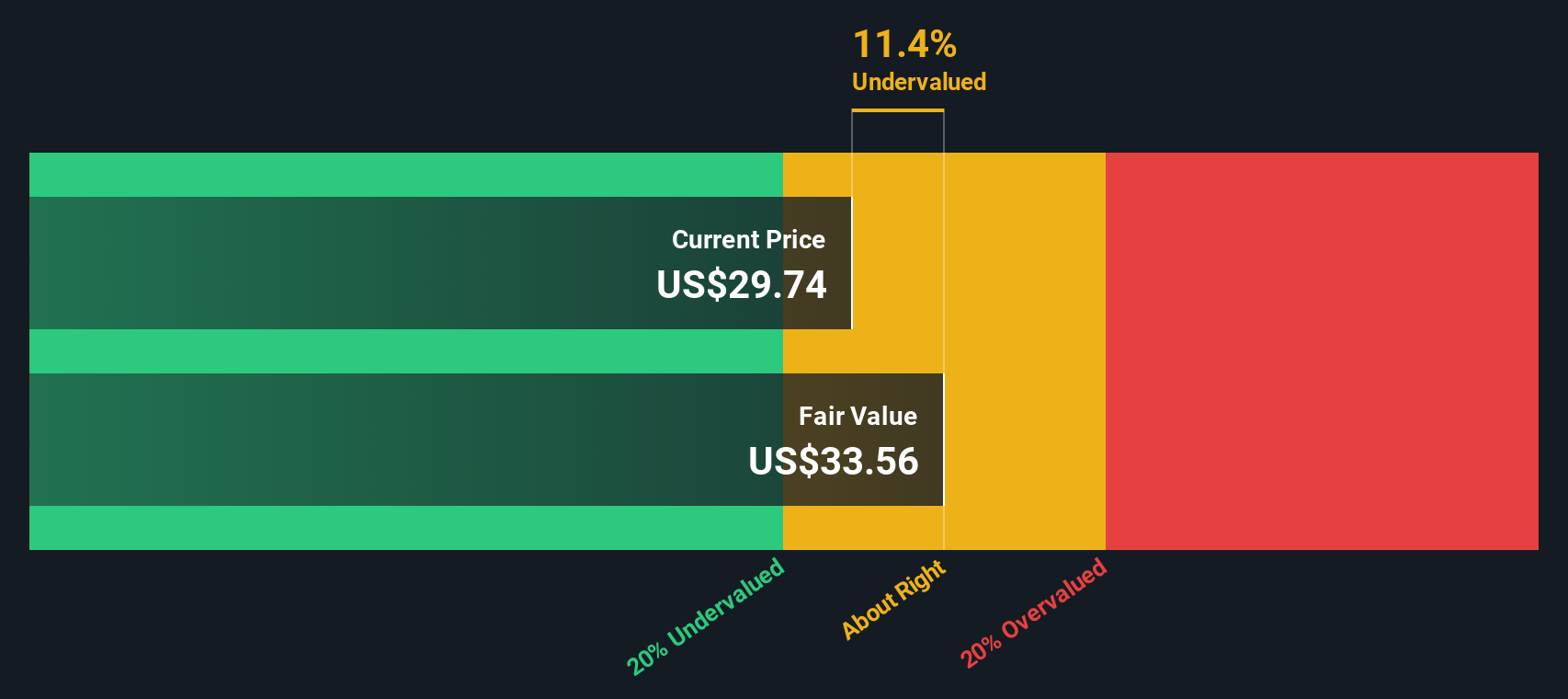

Discounted Cash Flow (DCF) Model Perspective

A Discounted Cash Flow (DCF) model provides an alternative valuation, estimating HASI’s intrinsic value at $36.63 per share. This figure is approximately 6.2% higher than its current trading price, suggesting the stock may be undervalued. The DCF model, which focuses on long-term cash generation, may more accurately reflect the enduring value of sustainable infrastructure assets that are essential for achieving global SDG targets.

Analysis of Sustainable Development Goals in the Article

-

Which SDGs are addressed or connected to the issues highlighted in the article?

The article’s focus on HA Sustainable Infrastructure Capital (HASI) and its issuance of “Green Junior Subordinated Notes” for “sustainability initiatives” connects to several Sustainable Development Goals (SDGs). These goals are linked through the themes of financing sustainable infrastructure, promoting clean energy, and mobilizing financial resources for climate action.

- SDG 7: Affordable and Clean Energy: Sustainable infrastructure projects often include renewable energy generation and distribution, which is central to this goal.

- SDG 9: Industry, Innovation and Infrastructure: The company’s name and core business, “Sustainable Infrastructure,” directly align with the goal of building resilient, sustainable, and reliable infrastructure.

- SDG 11: Sustainable Cities and Communities: The development of sustainable infrastructure is a critical component for creating cities and communities that are inclusive, safe, resilient, and sustainable.

- SDG 13: Climate Action: The issuance of “Green Notes” is a direct financial mechanism to fund projects that contribute to climate change mitigation and adaptation, which is the core of SDG 13.

- SDG 17: Partnerships for the Goals: This goal emphasizes the importance of mobilizing financial resources. The article discusses a $500 million capital raise from private investors, which is a clear example of mobilizing finance for sustainable development.

-

What specific targets under those SDGs can be identified based on the article’s content?

The article’s information on financing sustainable infrastructure points to several specific SDG targets:

- Target 7.a: “By 2030, enhance international cooperation to facilitate access to clean energy research and technology… and promote investment in energy infrastructure and clean energy technology.” The $500 million in Green Notes is a direct form of investment promotion for sustainable initiatives, which often include clean energy infrastructure.

- Target 9.1: “Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being.” HASI’s entire business model is focused on investing in and developing sustainable infrastructure, directly contributing to this target.

- Target 9.a: “Facilitate sustainable and resilient infrastructure development in developing countries through enhanced financial… support.” While the article doesn’t specify the location of the projects, green bonds are a key instrument for providing enhanced financial support for such infrastructure globally.

- Target 13.a: “Implement the commitment undertaken by developed-country parties… to a goal of mobilizing jointly $100 billion annually… to address the needs of developing countries…” The issuance of green bonds by a private entity like HASI contributes to the broader pool of climate finance available for mitigation and adaptation projects.

- Target 17.3: “Mobilize additional financial resources for developing countries from multiple sources.” The $500 million issuance represents the mobilization of private capital, a key source of financing for achieving the SDGs.

-

Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

The article, being a financial analysis, does not cite official SDG indicators. However, it provides several quantitative and qualitative data points that can serve as proxy indicators for measuring progress, particularly concerning the mobilization of financial resources.

- Direct Financial Indicator: The most direct indicator is the “$500 million in 8.000% Green Junior Subordinated Notes.” This figure quantifies the amount of private capital mobilized specifically for sustainability initiatives, directly measuring financial flows related to targets 7.a, 9.a, and 17.3.

- Market Performance Indicators: The article mentions a “23.9% gain over the past month” in share price and a “1-year total shareholder return of 16.2%.” These figures act as indirect indicators of investor confidence and the financial viability of sustainability-focused investments. Strong returns can attract more capital towards sustainable infrastructure, thereby accelerating progress towards the SDGs.

- Valuation Indicator: The “Price-to-Earnings (P/E) ratio of 14.2x” is used to gauge market expectations for future profitability from green finance. A stable or growing P/E ratio can indicate that the market views sustainability-driven growth as a reliable source of value, encouraging further investment in the sector.

-

Create a table with three columns titled ‘SDGs, Targets and Indicators” to present the findings from analyzing the article.

SDGs Targets Indicators SDG 7: Affordable and Clean Energy 7.a: Promote investment in energy infrastructure and clean energy technology. Amount of capital raised through Green Notes ($500 million). SDG 9: Industry, Innovation and Infrastructure 9.1: Develop quality, reliable, sustainable and resilient infrastructure. Investment in a company focused on “Sustainable Infrastructure.” SDG 13: Climate Action 13.a: Implement commitments to mobilize climate finance. Issuance of “Green Junior Subordinated Notes” as a climate finance instrument. SDG 17: Partnerships for the Goals 17.3: Mobilize additional financial resources from multiple sources. Value of mobilized private capital ($500 million); Market performance metrics (share price gain, shareholder return) indicating investor confidence.

Source: simplywall.st

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0