The Green Leap – Unlocking climate financing at COP30 – Oxford Economics

Report on Climate Financing for Sustainable Development at COP30

Executive Summary

The 30th Conference of the Parties (COP30) represents a critical juncture for the international community to align climate finance mechanisms with the Sustainable Development Goals (SDGs), particularly SDG 13 (Climate Action) and SDG 17 (Partnerships for the Goals). This report finds a significant shortfall in the funding required by developing economies to meet climate targets, which jeopardizes the entire 2030 Agenda. The analysis highlights the following key points:

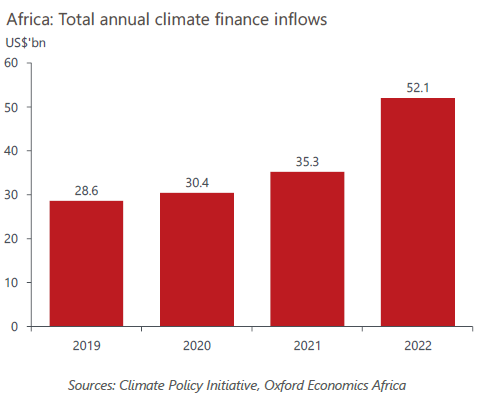

- The current climate finance architecture disproportionately affects the African continent, exacerbating inequalities and undermining SDG 10 (Reduced Inequalities). The continent received only $52 billion in 2022 against an annual requirement of at least $190 billion.

- Existing financial pledges, including the $300 billion annual target set at COP29, are insufficient to address the trillions required for effective climate mitigation and adaptation, thereby hindering progress on SDG 7 (Affordable and Clean Energy) and SDG 1 (No Poverty).

- An over-reliance on concessional loans from public lenders is increasing the debt burden on developing nations, which conflicts with the objectives of SDG 8 (Decent Work and Economic Growth). Private capital is deterred by high costs and perceived risks.

- Proposed reforms, such as the establishment of a ‘green IMF’ and the implementation of the Bridgetown Initiative, offer pathways to reform the global financial system in line with SDG 17, creating fairer and more effective financing for climate action.

The Climate Finance Imperative for Sustainable Development at COP30

The primary agenda for the UNFCCC’s COP30 is the mobilization of climate finance for developing nations. This objective is central to the achievement of SDG 13 (Climate Action), which calls for urgent action to combat climate change and its impacts. The failure to adequately fund mitigation and adaptation efforts presents a systemic risk to the broader 2030 Agenda for Sustainable Development, as climate shocks directly threaten progress on poverty, hunger, health, and economic stability.

Addressing the Funding Disparity: A Focus on SDG 10 and SDG 13

A significant gap persists between climate finance pledges and the actual needs of developing economies. This disparity undermines the principle of shared responsibility and contravenes the goals of SDG 10 (Reduced Inequalities).

- Insufficient Pledges: The pledge made at COP29 by wealthy nations for at least $300 billion a year by 2035 falls drastically short of the trillions required to meet global climate goals under SDG 13.

- Regional Imbalance in Africa: Despite being disproportionately affected by climate change, Africa received just $52 billion in climate finance in 2022, a fraction of the estimated $190 billion needed annually. This funding is further concentrated in a small number of countries.

- Adaptation vs. Mitigation: The allocation of funds is heavily skewed toward mitigation projects. This leaves adaptation efforts, which are critical for protecting vulnerable communities and ensuring progress on SDG 1 (No Poverty) and SDG 2 (Zero Hunger), severely underfunded.

The Debt Burden and the Role of Public vs. Private Capital

The current model of climate finance is unsustainable, creating economic instability that conflicts with SDG 8 (Decent Work and Economic Growth). A new approach is needed to foster robust public-private partnerships as envisioned in SDG 17.

- Public Funding and Debt: The majority of Africa’s climate funding is sourced from public lenders through concessional loans. This practice contributes to rising debt loads, limiting the fiscal space for other essential development expenditures.

- Barriers to Private Investment: Private sector capital is crucial for closing the funding gap. However, private investors are deterred by high upfront costs and weak credit ratings in many developing nations.

- De-risking Investment: De-risking climate investments through innovative financial instruments and policy frameworks is vital. This will be essential to unlock the private capital needed to finance large-scale projects, such as those under SDG 7 (Affordable and Clean Energy).

Proposed Mechanisms for Unlocking Finance and Achieving the SDGs

To accelerate progress, leaders at COP30 are urged to consider bold reforms to the global financial architecture. These proposals aim to create a more equitable and effective system for channeling funds toward climate action and sustainable development.

- A ‘Green IMF’: The creation of a global climate finance coalition, or ‘green IMF’, could link funding directly to emissions reductions, creating a powerful incentive mechanism for achieving the targets of SDG 13.

- The Bridgetown Initiative: Continued support for the Bridgetown Initiative is essential. Its focus on fairer lending terms and debt relief for climate-vulnerable countries directly supports the aims of SDG 10 and strengthens the global partnership under SDG 17.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 13: Climate Action

- The article’s central theme is climate change, focusing on the need for funds to help developing economies “curb emissions” (mitigation) and “adapt to climate shocks” (adaptation). This directly aligns with the goal of taking urgent action to combat climate change and its impacts.

-

SDG 17: Partnerships for the Goals

- The article extensively discusses the financial mechanisms and international cooperation required to address climate change. It highlights the role of “wealthy countries,” “public lenders,” and “private investors” in providing climate finance. The call for “reforming the global financial architecture,” promoting “fairer lending terms,” and ensuring “debt relief” are all core components of strengthening the means of implementation and revitalizing the global partnership for sustainable development.

-

SDG 10: Reduced Inequalities

- The article points out the disparity between nations, noting that “Africa bears the brunt of climate change impact” yet receives only a fraction of the necessary funding. The discussion around the “Bridgetown Initiative,” which champions fairer lending and debt relief for “climate-vulnerable countries,” directly addresses the goal of reducing inequality within and among countries.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

Under SDG 13 (Climate Action):

- Target 13.a: “Implement the commitment undertaken by developed-country parties…to a goal of mobilizing jointly $100 billion annually…to address the needs of developing countries…” The article directly addresses this by discussing the “gaping shortfall in funds,” the previous COP29 pledge of “$300bn a year by 2035,” and the specific financial needs of Africa.

- Target 13.1: “Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries.” The article explicitly mentions the need for funds to help developing economies “adapt to climate shocks” and laments that funding is “skewed toward mitigation projects, leaving adaptation in the lurch.”

-

Under SDG 17 (Partnerships for the Goals):

- Target 17.3: “Mobilize additional financial resources for developing countries from multiple sources.” The entire article is about this target, discussing the need to unlock private capital, the role of public lenders, and the necessity of reforming the global financial architecture to close the “massive funding gap.”

- Target 17.4: “Assist developing countries in attaining long-term debt sustainability through coordinated policies aimed at fostering debt financing, debt relief and debt restructuring…” This is clearly identified through the mention of the “Bridgetown Initiative, which champions fairer lending terms and debt relief” and the problem that current climate funding “comes from public lenders and concessional loans, adding to already heavy debt loads.”

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

Indicators for Financial Flows (Targets 13.a and 17.3):

- Total Climate Finance Pledged: The article mentions a specific pledge from wealthy countries of “at least $300bn a year by 2035.” This serves as a direct quantitative indicator of commitment.

- Total Climate Finance Received: The article provides a concrete figure for Africa, which “received just $52bn in 2022.” This is an indicator of actual mobilized funds.

- Climate Finance Gap: The article quantifies the need, stating Africa requires “at least $190bn needed yearly.” The gap between the needed amount ($190bn) and the received amount ($52bn) is an implied indicator of the shortfall.

-

Indicators for Fund Allocation and Quality (Targets 13.1 and 17.4):

- Allocation to Adaptation vs. Mitigation: The article implies an indicator by stating that funds are “skewed toward mitigation projects, leaving adaptation in the lurch.” The proportion of total climate finance directed towards adaptation projects would be the measurable indicator.

- Debt Sustainability: An implied indicator is the impact of climate finance on the debt burden of developing countries. The article notes that funding “comes from public lenders and concessional loans, adding to already heavy debt loads,” suggesting that the change in debt-to-GDP ratios in recipient countries could be tracked.

- Mobilization of Private Capital: The article states that “High costs and weak credit ratings deter private investors.” An indicator would be the ratio of public to private climate finance, with an increase in the private share indicating progress in de-risking investments.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 13: Climate Action | 13.a: Mobilize climate finance from developed to developing countries. |

|

| 13.1: Strengthen resilience and adaptive capacity to climate-related hazards. |

|

|

| SDG 17: Partnerships for the Goals | 17.3: Mobilize additional financial resources for developing countries from multiple sources. |

|

| 17.4: Assist developing countries in attaining long-term debt sustainability. |

|

Source: oxfordeconomics.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0