Figure 1: Battery storage capacity deployment has accelerated in recent years – Macquarie

Executive Report: Strategic Realignment for Sustainable Development

This report outlines a strategic corporate transaction and the guiding principles of our market engagement, with a direct focus on advancing the United Nations Sustainable Development Goals (SDGs). The information herein details our commitment to fostering sustainable economic growth, building resilient infrastructure, and ensuring institutional integrity.

A Partnership for Global Goals (SDG 17)

In a significant move to enhance global partnerships for sustainable development, Macquarie Group Limited and Nomura Holding America Inc. have entered into an agreement for Nomura to acquire Macquarie Asset Management’s US and European public investments business. This transaction, anticipated to close by the end of 2025 subject to regulatory and client approvals, is designed to strengthen the global financial architecture for achieving the SDGs.

Guiding Principles for Sustainable Investment Commentary

All market commentary and analysis are prepared to support and inform investment strategies that contribute to a sustainable and equitable future. Our approach is rooted in principles of responsibility, innovation, and transparency.

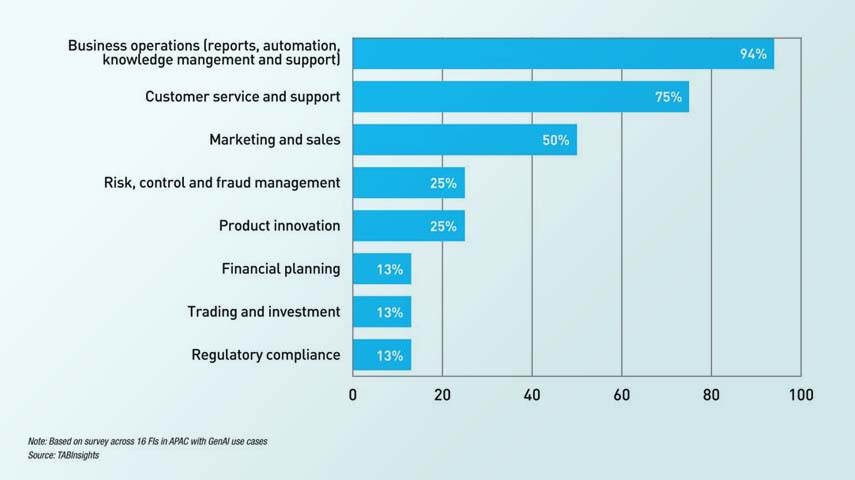

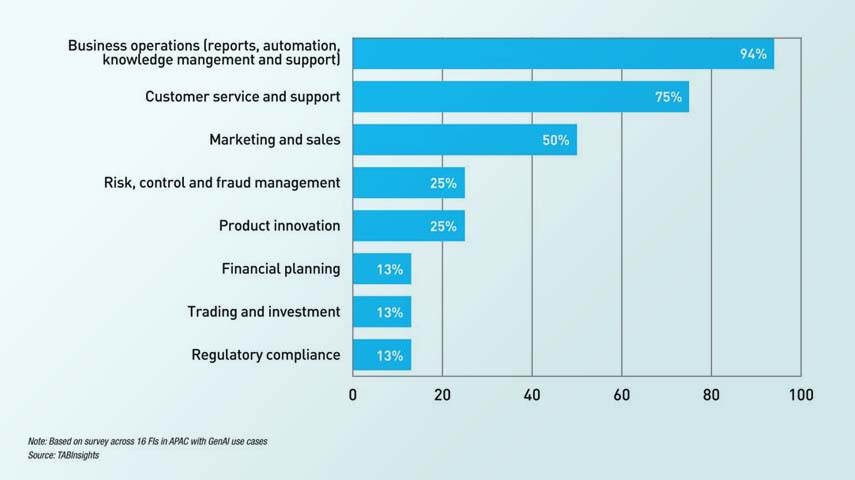

Commitment to SDG 9: Industry, Innovation, and Infrastructure

Our insights are developed to guide capital towards sustainable industries and resilient infrastructure, such as the battery storage solutions critical for a clean energy transition. The objective is to provide information that supports investment in innovative and sustainable enterprises.

- Market perspectives are dynamic, reflecting the evolving landscape of sustainable technologies and climate-resilient infrastructure.

- Information is prepared for general informational purposes to encourage broad participation in financing sustainable development.

- This commentary is intentionally distinct from formal investment research to allow for agile and timely insights into emerging green markets.

Upholding SDG 12: Responsible Consumption and Production

We are committed to promoting responsible investment patterns. This report does not constitute a solicitation for any specific financial product but serves as a tool to encourage thoughtful and sustainable capital allocation.

- Investors are encouraged to conduct due diligence to ensure alignment with their specific sustainability objectives and financial circumstances.

- Before making an investment decision, consideration must be given to its contribution to global goals, such as Affordable and Clean Energy (SDG 7) and Sustainable Cities and Communities (SDG 11).

- This commentary should be used as a component of a comprehensive assessment, ideally with the assistance of an adviser, to ensure investment strategies are appropriate and impactful.

Framework for Institutional Integrity and Partnership (SDG 16 & 17)

Our operational framework is built on a foundation of transparency and accountability, ensuring our activities contribute to building effective and just institutions.

Managing Conflicts of Interest for Collective Goals

In a global and interconnected financial system, we recognize the potential for conflicts of interest. We are committed to managing these transparently to ensure our actions remain aligned with the broader objectives of sustainable development.

- Robust conflict of interest policies are in place to manage the diverse roles Macquarie Group entities may play.

- Our primary goal is to ensure that all business relationships and financial interests are managed in a way that supports, rather than hinders, progress on the SDGs.

- We prioritize long-term sustainable outcomes, ensuring our diverse business functions work in concert toward shared global goals.

Forward-Looking Statements and Risk Mitigation for Resilient Growth (SDG 8)

Forward-looking statements and financial projections are tools to help navigate the transition to a sustainable global economy. They are provided to help stakeholders understand potential pathways and risks associated with sustainable investments.

- Investing in sustainable development involves risks, including those related to currency fluctuations, regulatory changes, and market conditions.

- Projections regarding future performance are based on assumptions about the trajectory of sustainable economic growth and should not be seen as guarantees.

- Past performance is not an indicator of future results, particularly as the global economy shifts towards new, sustainable models.

Corporate Structure and Accountability

Macquarie Group’s structure is designed to support a diverse range of capabilities necessary for financing the transition to a sustainable world.

Macquarie Asset Management’s Role in Advancing SDGs

As the asset management division of Macquarie Group, Macquarie Asset Management (MAM) offers integrated capabilities across real assets, real estate, credit, and equities. These functions are critical levers for mobilizing capital towards key SDGs, including SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 11 (Sustainable Cities and Communities).

Regulatory and Financial Governance (SDG 16)

In the interest of transparency and strong governance, it is noted that Macquarie Group entities, other than Macquarie Bank Limited (ABN 46 008 583 542), are not authorised deposit-taking institutions under the Banking Act 1959 (Commonwealth of Australia). Macquarie Bank does not guarantee the obligations of other Group entities. This structural clarity ensures accountability and reinforces our commitment to operating as a responsible and effective institution in the global financial system.

SDGs Addressed or Connected

- Based on a thorough analysis of the provided text, the article does not contain sufficient information to identify any relevant Sustainable Development Goals (SDGs). The text is a corporate announcement regarding an acquisition agreement between Macquarie Group and Nomura, followed by extensive legal and financial disclaimers. It does not discuss any environmental, social, or economic development issues, policies, or outcomes that align with the SDG framework.

Specific Targets Identified

- As no SDGs could be directly linked to the content of the article, no specific targets can be identified. The text focuses on the terms of a business transaction, potential conflicts of interest, and investment risks, rather than on objectives related to sustainable development.

Indicators Mentioned or Implied

- The article does not mention or imply any indicators that could be used to measure progress towards SDG targets. The content consists of qualitative legal and financial statements and does not provide any data, metrics, or performance measurements related to sustainability.

Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| Not applicable as the article does not contain relevant information. | Not applicable as the article does not contain relevant information. | Not applicable as the article does not contain relevant information. |

Source: macquarie.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

;Resize=620#)