Is American Water Works a Bargain After Recent Infrastructure Investment News? – simplywall.st

Valuation and Sustainability Report: American Water Works Company (AWK)

Executive Summary: Market Performance and SDG Context

This report provides a valuation analysis of American Water Works Company, contextualized by its strategic alignment with the United Nations Sustainable Development Goals (SDGs). The company’s stock performance has been volatile, reflecting a market weighing short-term financial metrics against long-term, capital-intensive infrastructure investments. These investments are critical for advancing key SDGs, particularly those related to water, infrastructure, and sustainable communities.

- Past Week Performance: +0.9%

- Past Month Performance: -7.6%

- Past Year Performance: -1.0%

The market’s mixed response is influenced by regulatory decisions and the company’s focus on long-term upgrades. These actions directly support the resilience and sustainability of water infrastructure, aligning with SDG 6 (Clean Water and Sanitation) and SDG 9 (Industry, Innovation, and Infrastructure), but create uncertainty regarding immediate stock valuation.

Financial Valuation Analysis

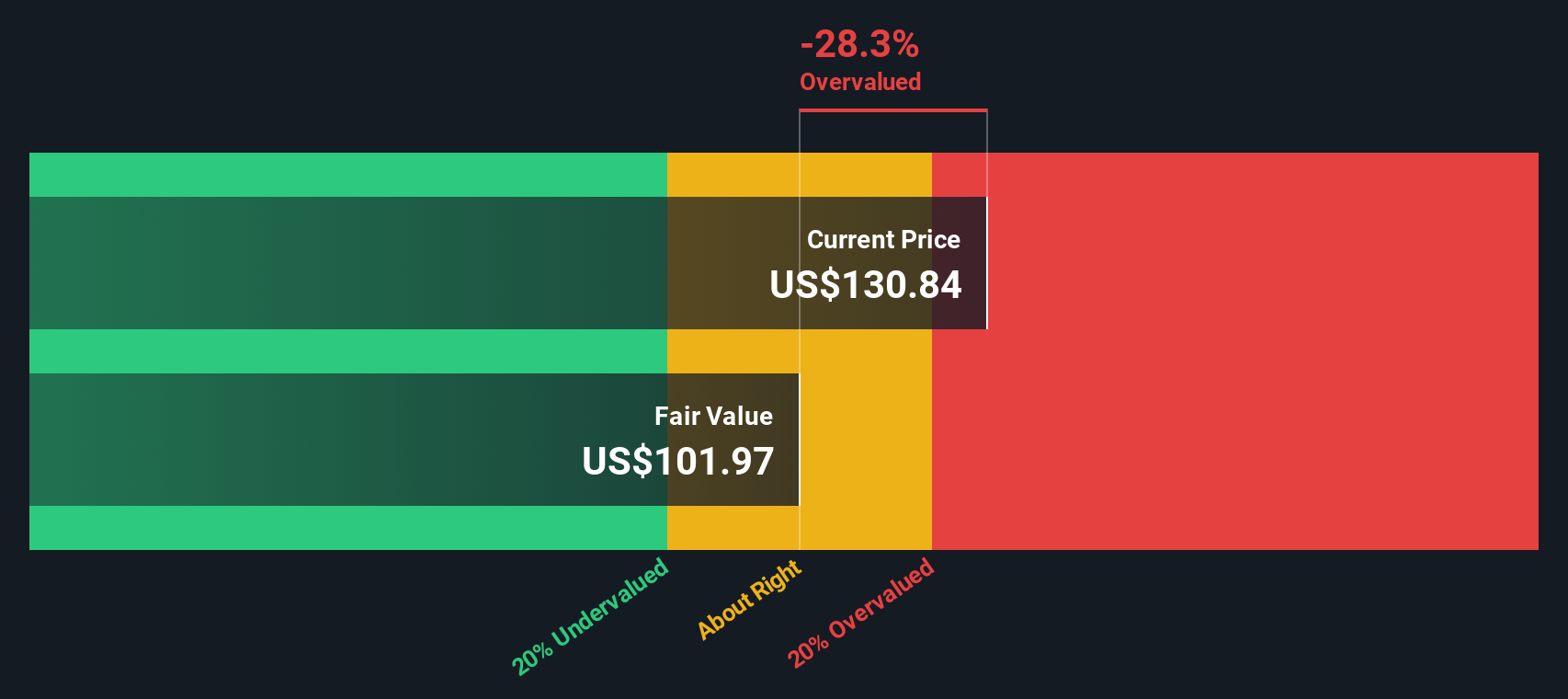

An assessment based on standard valuation models indicates that American Water Works Company stock is currently overvalued. The analysis utilized two primary methods: the Dividend Discount Model (DDM) and the Price-to-Earnings (PE) ratio.

Approach 1: Dividend Discount Model (DDM)

The DDM analysis, which is suitable for stable, dividend-paying companies, suggests a significant overvaluation. The model’s inputs and results are as follows:

- Annual Dividend Per Share: $3.77

- Payout Ratio: 56.2%

- Sustainable Dividend Growth Rate: 3.26%

- Return on Equity: 10.4%

- DDM Intrinsic Value Estimate: $101.97 per share

- Conclusion: The current share price is approximately 30.2% above the DDM-estimated value, indicating the stock is OVERVALUED.

The company’s ability to sustain dividends is supported by its essential role in providing services aligned with SDG 6, ensuring financial stability for long-term infrastructure projects.

Approach 2: Price-to-Earnings (PE) Ratio

A comparative analysis using the PE ratio also points to a premium valuation. The company’s PE ratio exceeds that of its industry and peer group, as well as its own calculated Fair Ratio.

- American Water Works Company PE Ratio: 23.29x

- Water Utilities Industry Average PE: 15.79x

- Peer Group Average PE: 18.36x

- Simply Wall St Fair Ratio: 21.90x

- Conclusion: The company’s PE ratio is modestly above its Fair Ratio, suggesting the stock is OVERVALUED.

This premium may reflect investor confidence in the company’s long-term growth prospects, driven by the increasing importance of water security and sustainable infrastructure as outlined in SDG 11 (Sustainable Cities and Communities).

Strategic Alignment with Sustainable Development Goals (SDGs)

American Water Works Company’s core operations and capital investment strategy are fundamentally linked to the achievement of several key SDGs. This alignment is a critical factor for long-term value creation, even if not fully captured by traditional valuation metrics.

- SDG 6: Clean Water and Sanitation: The company’s primary mission is to provide safe and reliable water services. Infrastructure investments directly contribute to ensuring the availability and sustainable management of water for all.

- SDG 9: Industry, Innovation, and Infrastructure: Aggressive investments in upgrading water systems build resilient infrastructure, promoting inclusive and sustainable industrialization and fostering innovation in water management.

- SDG 11: Sustainable Cities and Communities: By ensuring a stable supply of clean water, the company provides a foundational service that makes cities and human settlements inclusive, safe, resilient, and sustainable.

- SDG 13: Climate Action: Modernizing infrastructure enhances resilience to climate-related challenges such as droughts and floods, contributing to climate action and adaptation efforts.

Conclusion and Investor Outlook

The valuation of American Water Works Company presents a dichotomy between current financial models and its long-term strategic direction centered on sustainability.

- Valuation Findings: Both the DDM and PE ratio analyses conclude that the company’s stock is currently overvalued from a purely financial standpoint.

- SDG Impact: The company’s business model is intrinsically aligned with critical global sustainability targets, creating non-financial value and positioning it for long-term resilience and growth.

- Investor Perspectives: Divergent investor outlooks, with price targets ranging from $116.00 to $159.00, highlight the ongoing debate on how to value a company whose mission is tied to achieving essential public and environmental goals.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

Based on the article’s content, the following Sustainable Development Goals (SDGs) are addressed:

-

SDG 6: Clean Water and Sanitation

The article focuses on the American Water Works Company, which is explicitly identified as part of the “Water Utilities industry.” The core business of such a company is the provision of water, which is the central theme of SDG 6. The discussion of its “infrastructure investments” and “long-term upgrades” directly relates to the systems required to provide clean and accessible water. -

SDG 9: Industry, Innovation and Infrastructure

The article repeatedly emphasizes the company’s strategic focus on infrastructure. Phrases like “infrastructure investments,” “long-term upgrades,” and “aggressive infrastructure investments” point directly to the development and maintenance of critical infrastructure. SDG 9 aims to build resilient infrastructure, and the company’s actions to upgrade its water systems align with this objective, especially when coupled with its stated “sustainability commitments.”

2. What specific targets under those SDGs can be identified based on the article’s content?

The article’s information points to the following specific SDG targets:

-

Target 6.1: “By 2030, achieve universal and equitable access to safe and affordable drinking water for all.”

As a water utility, American Water Works Company’s primary function is to provide drinking water to its customers. The article’s mention of “infrastructure investments” and “long-term upgrades” describes the necessary actions to maintain and potentially expand the reliability and safety of the water supply, thereby contributing directly to achieving this target within its service areas. -

Target 9.1: “Develop quality, reliable, sustainable and resilient infrastructure… to support economic development and human well-being…”

This target is directly addressed through the company’s strategic actions. The article highlights that “American Water Works Company’s infrastructure investments and regulatory decisions” are key factors for investors. The focus on “long-term upgrades” and “sustainability commitments” shows an effort to build and maintain water infrastructure that is not only functional but also sustainable and resilient, which is the core of Target 9.1.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

The article does not mention any official SDG indicators. However, it implies a key performance indicator that can be used to measure progress toward the identified targets:

-

Implied Indicator: Financial Investment in Water Infrastructure

The article repeatedly points to “infrastructure investments” as a central part of the company’s strategy and a key point of interest for investors. While the exact monetary value is not provided, the text describes them as “aggressive.” This financial commitment serves as a tangible and measurable indicator of the company’s efforts to develop, maintain, and upgrade the water infrastructure. This investment is a direct measure of action taken to build the “quality, reliable, sustainable and resilient infrastructure” mentioned in Target 9.1 and to ensure the “access to safe… drinking water” outlined in Target 6.1.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 6: Clean Water and Sanitation | Target 6.1: Achieve universal and equitable access to safe and affordable drinking water for all. | Implied Indicator: The level of financial commitment and monetary value of “infrastructure investments” and “long-term upgrades” dedicated to water systems. |

| SDG 9: Industry, Innovation and Infrastructure | Target 9.1: Develop quality, reliable, sustainable and resilient infrastructure. | Implied Indicator: The monetary value of “aggressive infrastructure investments” aimed at improving the quality and sustainability of water utility infrastructure, as referenced in the company’s “sustainability commitments.” |

Source: simplywall.st

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0