FSGS Market Analysis and Forecast 2024-2034: Clinical Trials, Epidemiology, Medications, and Leading Companies by DelveInsight – The Globe and Mail

Focal Segmental Glomerulosclerosis (FSGS) Market Report: A Sustainable Development Goal Perspective

Executive Summary

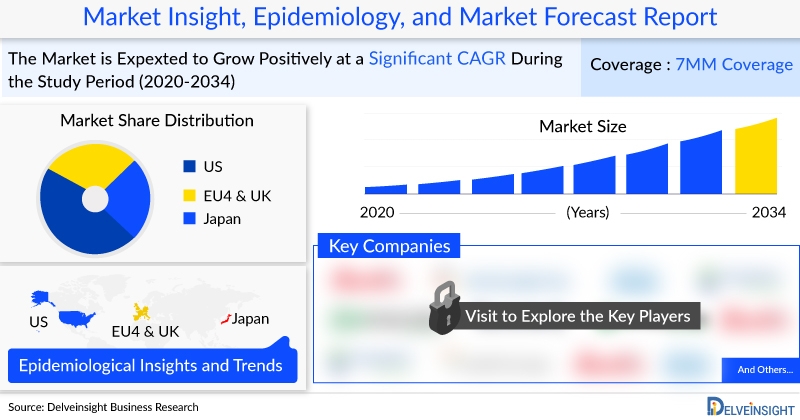

The global market for Focal Segmental Glomerulosclerosis (FSGS) is undergoing significant evolution, driven by advancements in therapeutic innovation and a growing patient population. In 2022, the market size across the seven major markets (7MM) was estimated at approximately USD 734 million, with projections indicating sustained growth through 2034. This expansion is critical for advancing United Nations Sustainable Development Goal 3 (SDG 3), which aims to ensure good health and well-being for all. The development and accessibility of new treatments for rare kidney diseases like FSGS directly contribute to reducing premature mortality from non-communicable diseases and achieving universal health coverage. This report analyzes the FSGS market landscape, therapeutic developments, and epidemiological trends through the lens of the SDGs, focusing on health outcomes (SDG 3), industry innovation (SDG 9), and health equity (SDG 10).

FSGS Market Analysis and Alignment with Sustainable Development Goals

Market Overview and Contribution to SDG 3

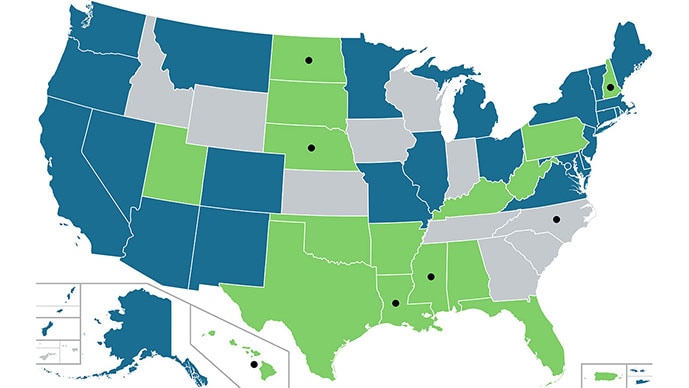

The FSGS market is poised for substantial growth, fueled by the anticipated approval of novel therapies. The market’s expansion reflects progress toward SDG 3 by addressing a high unmet medical need for a rare and debilitating kidney disorder. In 2022, the United States accounted for the largest share of the diagnosed patient population (46.96%), followed by Japan (14.83%). The total market value is projected to increase as new treatments become available, enhancing the quality of life and health outcomes for patients.

- 2022 Market Size (7MM): Approximately USD 734 million.

- US Market Share (2022): Accounted for 34% of the total market value.

- EU4 & UK Market Value (2022): Generated an estimated USD 147 million.

- Key Growth Driver: Introduction of innovative therapeutic agents and improved disease management protocols.

Epidemiological Insights and SDG 3 Targets

Understanding the prevalence of FSGS is fundamental to planning public health interventions aligned with SDG 3. In 2022, there were an estimated 55 million diagnosed prevalent cases of FSGS across the 7MM. Epidemiological data indicates a higher prevalence in males, suggesting a need for targeted research into genetic, hormonal, and environmental factors. Addressing the rising prevalence through effective treatments is essential for reducing the burden of chronic kidney disease globally.

- Total Diagnosed Cases (7MM, 2022): Approximately 55 million.

- United States Diagnosed Cases (2022): Approximately 26 million.

- Largest European Population (2022): Germany, with approximately 5 million diagnosed cases.

- Gender Disparity: FSGS is observed to be more prevalent in males than females in the United States.

Therapeutic Landscape and Innovation (SDG 9)

Current and Emerging Therapies

The FSGS treatment landscape is evolving from supportive care to targeted therapies, reflecting significant industry innovation in line with SDG 9. While current management often relies on corticosteroids and immunosuppressants, the pipeline of emerging drugs promises more effective and personalized options. These advancements are crucial for improving patient outcomes and achieving better health for those affected by this rare disease.

- Sparsentan (FILSPARI): A dual endothelin angiotensin receptor antagonist showing sustained proteinuria reduction. Travere Therapeutics’ supplemental New Drug Application (sNDA) for traditional approval was accepted by the FDA.

- Masitinib (AB1010): An oral tyrosine kinase inhibitor under evaluation in Phase III trials for its potential to slow cognitive decline associated with the disease.

- Valiltramiprosate (ALZ-801): An oral small-molecule prodrug in Phase III trials designed to block the formation of neurotoxic amyloid oligomers.

- Bezisterim (NE3107): An oral anti-inflammatory and insulin-sensitizing agent that has completed Phase III trials.

Key Corporate Stakeholders

A diverse range of pharmaceutical and biotechnology companies are investing in research and development to address the unmet needs in FSGS, driving the innovation required to meet global health goals.

- Travere Therapeutics

- Dimerix

- Vertex Pharmaceuticals

- GlaxoSmithKline

- AstraZeneca

- Sanofi

- Bristol-Myers Squibb

- Kyowa Kirin Co., Ltd.

- Genentech, Inc.

Market Dynamics: Drivers, Barriers, and SDG Implications

Market Drivers Supporting SDG 3 and SDG 9

Several factors are propelling the FSGS market forward, creating an environment conducive to achieving better health outcomes and fostering innovation.

- Innovative Pipeline: The commercialization of novel therapies, including siRNA drugs and other targeted agents, is a primary driver.

- Rising Prevalence and Awareness: Increased diagnosis and understanding of FSGS are expanding the patient pool requiring treatment.

- Advancements in Diagnostics: Improved diagnostic tools enable earlier and more accurate detection, facilitating timely intervention.

- Unmet Medical Need: The significant lack of approved, effective therapies continues to fuel robust R&D investment.

Market Barriers and Challenges to SDG 3 and SDG 10

Despite positive momentum, significant barriers remain that could hinder progress toward ensuring equitable access to care, a core principle of SDG 3 and SDG 10 (Reduced Inequalities).

- High Treatment Costs: The expense of novel therapies may limit patient access and create reimbursement challenges, exacerbating health inequalities.

- Disease Heterogeneity: The complex nature of FSGS complicates the development of universally effective treatments.

- Regulatory Hurdles: Stringent regulatory requirements and lengthy clinical development timelines can delay the availability of new medicines.

- Rare Disease Status: The limited patient population constrains the potential for market expansion and may disincentivize investment.

Conclusion: Advancing Health Equity for FSGS Patients

The Focal Segmental Glomerulosclerosis market is at a critical juncture. The development of innovative therapies directly supports the ambitions of SDG 3 and SDG 9 by offering new hope for patients and driving scientific progress. However, to fully realize these goals, stakeholders must address the significant barriers of cost and access. Ensuring that new treatments are not only effective but also affordable and accessible to all patients, regardless of geographic location or socioeconomic status, is essential for reducing health inequalities (SDG 10) and truly promoting well-being for all.

Analysis of Sustainable Development Goals in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

-

SDG 3: Good Health and Well-being

The article is entirely focused on Focal Segmental Glomerulosclerosis (FSGS), a rare kidney disorder. It discusses the disease’s prevalence, diagnosis, current treatments, and the development of new therapies. This directly aligns with SDG 3’s aim to ensure healthy lives and promote well-being for all at all ages, particularly concerning the management of non-communicable diseases.

-

SDG 9: Industry, Innovation, and Infrastructure

The article highlights the significant role of the pharmaceutical industry in addressing FSGS. It details the research and development efforts of numerous companies (e.g., Travere Therapeutics, AstraZeneca, Vertex Pharmaceuticals), the pipeline of “innovative therapies,” clinical trials, and the use of advanced therapeutic approaches like RNA interference (siRNA) drugs. This focus on scientific research, technological advancement, and industrial innovation is central to SDG 9.

2. What specific targets under those SDGs can be identified based on the article’s content?

-

SDG 3: Good Health and Well-being

-

Target 3.4: Reduce by one-third premature mortality from non-communicable diseases through prevention and treatment.

FSGS is a non-communicable disease that can lead to end-stage renal disease. The article’s focus on developing and approving new treatments like sparsentan, which “resulted in sustained proteinuria reduction,” is aimed at improving disease management and clinical outcomes, thereby contributing to the reduction of morbidity and premature mortality associated with FSGS.

-

Target 3.b: Support the research and development of vaccines and medicines for the communicable and non-communicable diseases.

This target is directly addressed through the article’s extensive discussion of the FSGS drug pipeline. It names numerous companies (GlaxoSmithKline, Sanofi, etc.) and specific investigational drugs (DMX-200, GFB-887, VX-147, Masitinib) in various stages of clinical trials (Phase II, Phase III), showcasing the active research and development in this therapeutic area.

-

-

SDG 9: Industry, Innovation, and Infrastructure

-

Target 9.5: Enhance scientific research, upgrade the technological capabilities of industrial sectors in all countries… encouraging innovation.

The article serves as a report on the progress of this target within the biopharmaceutical sector. It describes the “introduction and commercialization of innovative therapies,” mentions specific advancements like “RNA interference (siRNA) drugs,” and details the activities of companies investing in clinical trials (e.g., the DUPLEX trial) and seeking regulatory approvals from bodies like the FDA. This reflects a concerted effort to enhance scientific research and innovation to create new medical solutions.

-

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

-

For Target 3.4 (Treatment of NCDs):

- Improved Clinical Outcomes: The article implies progress by mentioning that new therapies lead to “enhanced clinical outcomes” and “improved disease management protocols.” The specific outcome of the DUPLEX trial, where sparsentan “resulted in sustained proteinuria reduction,” serves as a direct indicator of treatment efficacy.

- Disease Prevalence and Management Data: The article provides detailed epidemiological data, such as “roughly 55 million diagnosed prevalent cases of FSGS in the 7MM in 2022.” Tracking these numbers alongside the introduction of new treatments can help measure the impact on disease management.

-

For Target 3.b (Support for R&D):

- Number of Companies in R&D: The article lists over 15 “Key Focal Segmental Glomerulosclerosis Companies” (Travere Therapeutics, Dimerix, Vertex Pharmaceuticals, etc.) actively working on treatments.

- Number of Therapies in the Pipeline: A list of “Key Focal Segmental Glomerulosclerosis Therapies” (DMX-200, GFB-887, VX-147, etc.) is provided, indicating a robust pipeline of potential new medicines.

- Number of Clinical Trials: The text explicitly mentions multiple clinical trials, such as the “DUPLEX trial (NCT03493685)” and “Phase II/III” studies for various drug candidates, which are direct measures of R&D activity.

-

For Target 9.5 (Enhance Scientific Research and Innovation):

- Market Size and Growth: The market size, valued at “approximately USD 734 million in 2022” and projected to grow, reflects the level of private investment in R&D and innovation for FSGS.

- Regulatory Approvals: The mention of the “U.S. Food and Drug Administration (FDA)” accepting a “supplemental New Drug Application (sNDA) for traditional approval of FILSPARI (sparsentan)” is a concrete indicator of successful innovation moving from research to market availability.

- Development of Novel Therapeutic Modalities: The article highlights the emergence of “innovative therapies—such as RNA interference (siRNA) drugs like LEQVIO (Inclisiran) and pipeline agents like Olpasiran,” which demonstrates the upgrading of technological capabilities within the pharmaceutical industry.

4. Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 3: Good Health and Well-being | 3.4: Reduce premature mortality from non-communicable diseases through prevention and treatment. |

|

| SDG 3: Good Health and Well-being | 3.b: Support the research and development of vaccines and medicines for communicable and non-communicable diseases. |

|

| SDG 9: Industry, Innovation, and Infrastructure | 9.5: Enhance scientific research, upgrade the technological capabilities of industrial sectors… encouraging innovation. |

|

Source: theglobeandmail.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0