Farm bankruptcies are soaring amid low crop prices, while Trump considers bailout of up to $14 billion – Fortune

Report on Agricultural Economic Instability and its Implications for Sustainable Development Goals

Introduction: Rising Farm Bankruptcies and Threats to Sustainable Development

An ongoing crisis in the agricultural economy has led to a sharp increase in farm operation bankruptcies. This trend, marked by rising production costs and declining crop prices, poses a significant challenge to the achievement of several Sustainable Development Goals (SDGs), particularly SDG 1 (No Poverty), SDG 2 (Zero Hunger), and SDG 8 (Decent Work and Economic Growth).

Analysis of Current Agricultural Economic Conditions

Bankruptcy Filing Statistics

Data from the Federal Reserve Bank of Minneapolis indicates a concerning upward trend in farm bankruptcies since 2022, directly impacting the economic viability of rural communities and undermining progress towards SDG 8.

- Bankruptcy filings in the second quarter reached 93, an increase from 88 in the first quarter.

- This figure is nearly double the 47 filings recorded at the end of 2024.

- While current numbers remain below the peak of 169 in early 2020, the consistent increase signals growing economic distress.

Economic Drivers of the Agricultural Crisis

The financial instability facing farmers is driven by several economic factors that threaten the foundations of SDG 1 and SDG 2 by jeopardizing farmer livelihoods and the stability of food production systems.

- Production Costs: Farmers are experiencing significantly higher costs for inputs and equipment.

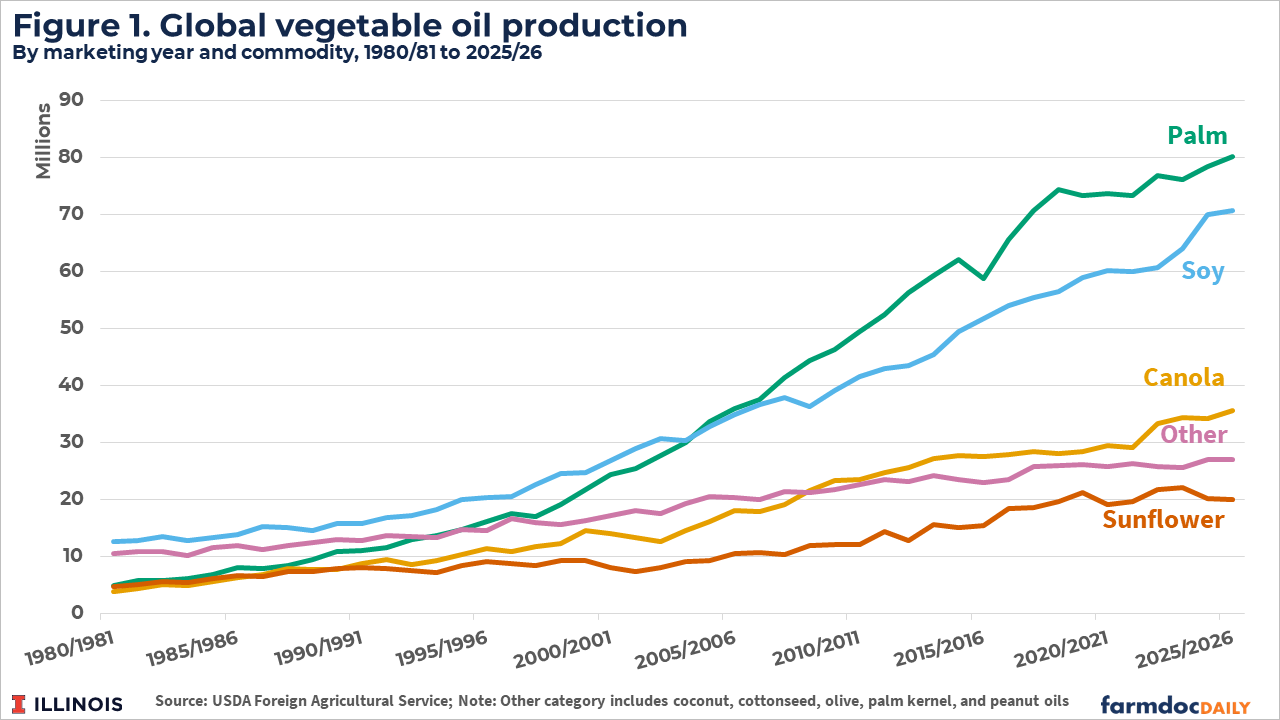

- Plunging Crop Prices: Since 2022, corn prices have fallen by approximately 50%, and soybean prices have declined by about 40%.

- Trade Disputes: Ongoing trade disputes have disrupted international partnerships, a key component of SDG 17 (Partnerships for the Goals). The lack of orders from China, a primary buyer of U.S. soybeans, has exacerbated financial stress on farmers.

Financial Health and Systemic Risks

Deteriorating Farm Financial Conditions

Federal Reserve surveys highlight a decline in farm financial health, characterized by reduced liquidity and worsening credit conditions. This financial deterioration weakens the agricultural sector’s contribution to SDG 8 (Decent Work and Economic Growth).

- Weaker farm income has reduced liquidity and increased the demand for financing.

- Loan repayment rates have declined, with reports of lower rates from respondents in multiple Federal Reserve districts:

- Chicago and Kansas City Districts: ~30%

- Minneapolis District: ~40%

- St. Louis District: ~50%

- While Chapter 12 bankruptcy filings can allow for restructuring rather than full liquidation, they signify severe financial distress that impacts the long-term sustainability of farm operations.

Policy Interventions and Sustainability Concerns

Government Support Measures

In response to the crisis, various government interventions have been implemented or proposed. However, their long-term effectiveness in promoting sustainable agricultural systems remains a concern.

- Income Support: The U.S. Department of Agriculture forecasts that approximately three-quarters of the growth in farm income this year will derive from government payments, indicating a dependency on subsidies rather than market stability.

- Legislative Action: The One Big Beautiful Bill Act included approximately $66 billion for agriculture, with $59 billion allocated for farm safety-net enhancements.

- Potential Bailouts: The administration is considering a bailout of $10 billion to $14 billion, funded by tariff revenue, to provide short-term relief.

Challenges to Long-Term Viability and SDG Alignment

Industry experts caution that short-term financial aid may not address the systemic issues threatening the agricultural sector, potentially hindering progress towards the SDGs.

- The “Capitalization” Effect: Government assistance can become capitalized over the long term, leading to increased rents and other operational costs, which limits the overall relief for farmers.

- Impact on Livelihoods: The American Soybean Association has warned that without stable markets, many farmers face extreme financial stress and the potential loss of their farms, directly contradicting the aims of SDG 1 (No Poverty) and SDG 2 (Zero Hunger).

- Call for Sustainable Partnerships: Agricultural groups are advocating for policy changes that foster long-term stability, such as resolving trade disputes to restore markets. This aligns with SDG 17, which emphasizes the need for global partnerships for sustainable development.

Analysis of Sustainable Development Goals (SDGs) in the Article

1. Which SDGs are addressed or connected to the issues highlighted in the article?

The article on the crisis in the agricultural economy, marked by a sharp increase in farm bankruptcies, connects to several Sustainable Development Goals (SDGs). These goals are relevant because the financial stability of farmers is directly linked to food security, poverty reduction, and overall economic health.

-

SDG 1: No Poverty

The article highlights the “extreme financial stress” faced by farmers, with some stating that “this could be their last year in farming.” The rise in bankruptcies and plunging incomes directly threaten the livelihoods of farming families, pushing them towards economic hardship and potential poverty.

-

SDG 2: Zero Hunger

This goal focuses on ending hunger, achieving food security, improving nutrition, and promoting sustainable agriculture. The article’s core subject—the financial crisis affecting farmers—directly impacts the viability of food production systems. The economic instability of farmers, who are the primary food producers, jeopardizes the stability of the food supply and the sustainability of agricultural practices.

-

SDG 8: Decent Work and Economic Growth

SDG 8 aims to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. The article describes a severe economic downturn in a key sector of the economy. The increase in bankruptcies, reduced farm incomes, and deteriorating credit conditions signify a lack of economic growth and stability for those working in agriculture.

-

SDG 17: Partnerships for the Goals

This goal emphasizes the need for global partnerships to achieve sustainable development. The article explicitly mentions the negative impact of a “trade war” with China, which has disrupted a major market for U.S. soybeans. This points to the critical role of international trade policies and partnerships in supporting economic sectors like agriculture.

2. What specific targets under those SDGs can be identified based on the article’s content?

Based on the issues discussed, several specific SDG targets can be identified:

-

Target 2.3: Double the agricultural productivity and incomes of small-scale food producers.

The article directly contradicts the aim of this target. It states that farmers are under “extreme financial stress” due to “plunging crop prices,” with corn and soybean prices falling by 50% and 40%, respectively. It also notes that while farm incomes are forecast to increase, “about three-quarters of that growth will come from an expected boost in government payments,” not from market-based income or productivity gains.

-

Target 2.4: Ensure sustainable food production systems and implement resilient agricultural practices.

The financial crisis described in the article threatens the sustainability of food production. Farmers facing bankruptcy and reduced liquidity are less likely to invest in resilient or sustainable practices. The article notes that “weaker income has reduced liquidity for farmers,” making it difficult to maintain, let alone improve, their operations for long-term sustainability.

-

Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

The article points to failures in this area for the agricultural sector. It highlights that “credit conditions deteriorated with roughly 30% of respondents…reporting lower repayment rates,” and that there is a “boosting demand for financing” due to reduced liquidity. This indicates that farmers are struggling to manage their finances and that existing financial systems are under strain.

-

Target 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system.

The article provides a clear example of how trade disruptions work against this target. The “trade war” has resulted in China, a “top buyer of U.S. soybeans,” ceasing to “place any orders with American farmers.” This situation undermines an open and stable trading system, directly harming the agricultural sector.

3. Are there any indicators mentioned or implied in the article that can be used to measure progress towards the identified targets?

Yes, the article contains several direct and implied indicators that can be used to measure the economic health of the agricultural sector and progress toward the identified targets.

-

Number of farm bankruptcies:

This is a primary indicator used throughout the article. The text states, “In the second quarter, there were 93 filings…up from 88 in the first quarter and nearly double the 47 at the end of 2024.” This directly measures the economic distress and failure rate within the farming community, relevant to SDG 1, 2, and 8.

-

Prices of agricultural commodities:

The article explicitly mentions the crash in crop prices as a key cause of the crisis: “corn prices have crashed about 50% since 2022, while soybean prices are down about 40%.” This serves as a direct indicator for Target 2.3, which concerns farmer incomes.

-

Loan repayment rates:

As an indicator of financial health and access to credit (Target 8.10), the article notes that credit conditions have “deteriorated with roughly 30% of respondents in the Chicago Fed and Kansas City Fed districts reporting lower repayment rates versus a year ago.”

-

Dependence on government payments:

The article implies this as an indicator of a non-sustainable market. It states that “about three-quarters of [farm income] growth will come from an expected boost in government payments.” This shows that the sector’s income is not self-sustaining, which is relevant to Target 2.3.

-

Volume of agricultural exports:

Related to Target 17.10, the article implies that the volume of soybean exports to China has plummeted. It states the trade war has kept China “from placing any orders with American farmers.” Tracking these export volumes would be a key indicator of the impact of trade policies.

4. Summary Table of SDGs, Targets, and Indicators

| SDGs | Targets | Indicators |

|---|---|---|

| SDG 2: Zero Hunger | Target 2.3: Double the agricultural productivity and incomes of small-scale food producers. |

|

| SDG 8: Decent Work and Economic Growth | Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to financial services. |

|

| SDG 17: Partnerships for the Goals | Target 17.10: Promote a universal, rules-based, open, non-discriminatory and equitable multilateral trading system. |

|

| SDG 1: No Poverty | Target 1.2: Reduce at least by half the proportion of people living in poverty in all its dimensions according to national definitions. |

|

Source: fortune.com

What is Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0